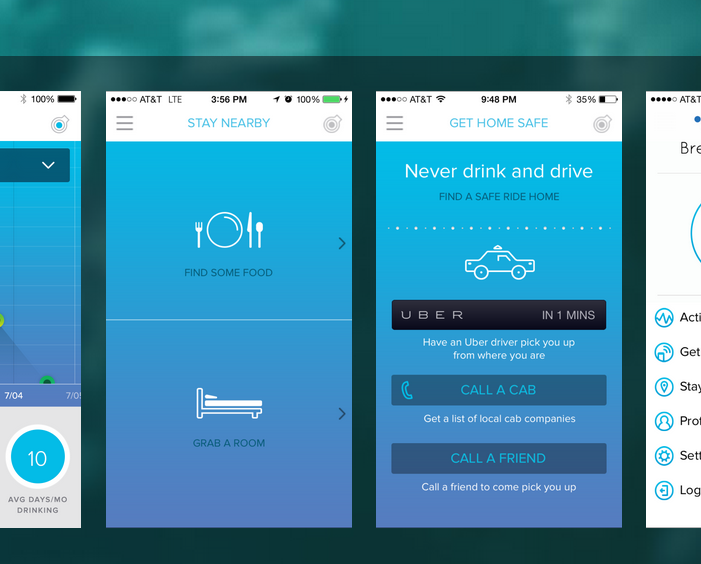

According to a leaked email from Uber CEO Travis Kalanick, Uber is seeing tremendous growth in the Chinese market, logging in 1 million daily rides, which is as many as Uber has in all of its global markets combined. Encouraged by the promising prospects, Kalanick revealed the company intends to raise $1 billion specifically for Uber’s expansion in China.

While the numbers may seem impressive as a standalone, they pale in comparison to Uber’s competitors in China. Kuaidi and Didi, two most popular cab-hailing apps in China backed respectively by domestic giants Alibaba and Tencent, both report that they each book up to 6 million rides a day. And a surprise merger of the two announced back in February created Kuaidi-Didi, a mammoth that now cover over 95% of the market share.

For now, Uber only operates in 11 cities in China, and its recent fast growth is likely due to its newfound alliance with Baidu, who, interestingly, is looking to launch a driverless car later this year. In the face of the formidable Kuaidi-Didi and other obstacles such as crackdowns from local authorities, Uber sure has an uphill battle to fight if it were to win over the Chinese market.

Update 06/15/2015: Right on the heels of UberChina’s $1 billion fundraising plan, Didi Kuaidi counteracts by seeking $1.5 billion in new funding round.