What Happened

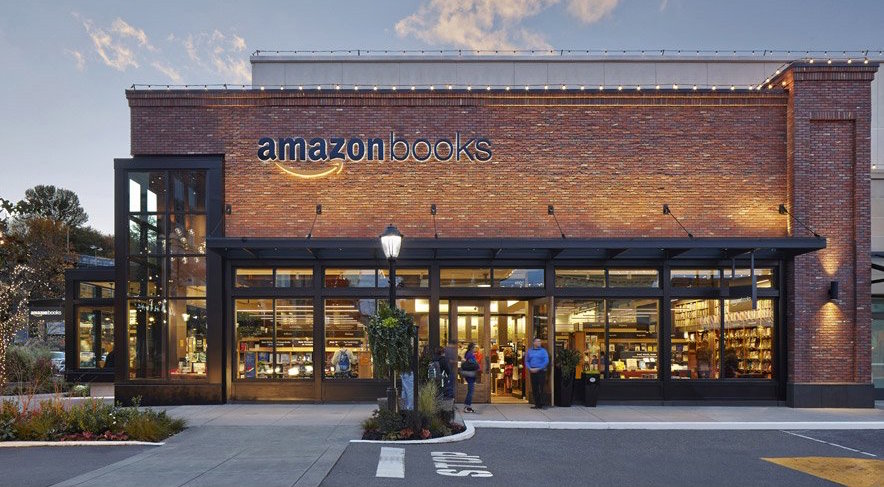

Upscale retailer Barneys New York is opening a new flagship store in the Chelsea neighborhood of New York City, and it comes equipped with new retail technologies that aim to elevate the shopping experience. Barneys is launching a new beacon network in the store that can send location-based notifications to customers who have Barneys’ app installed on their phones. The sales staff will also be equipped with tablets so they can quickly pull up customer profiles and make personalized recommendations to shoppers based on their purchase history. Moreover, the retailer is also launching same-day delivery service for online shoppers in select areas of Manhattan and Brooklyn.

What Retailers Need To Do

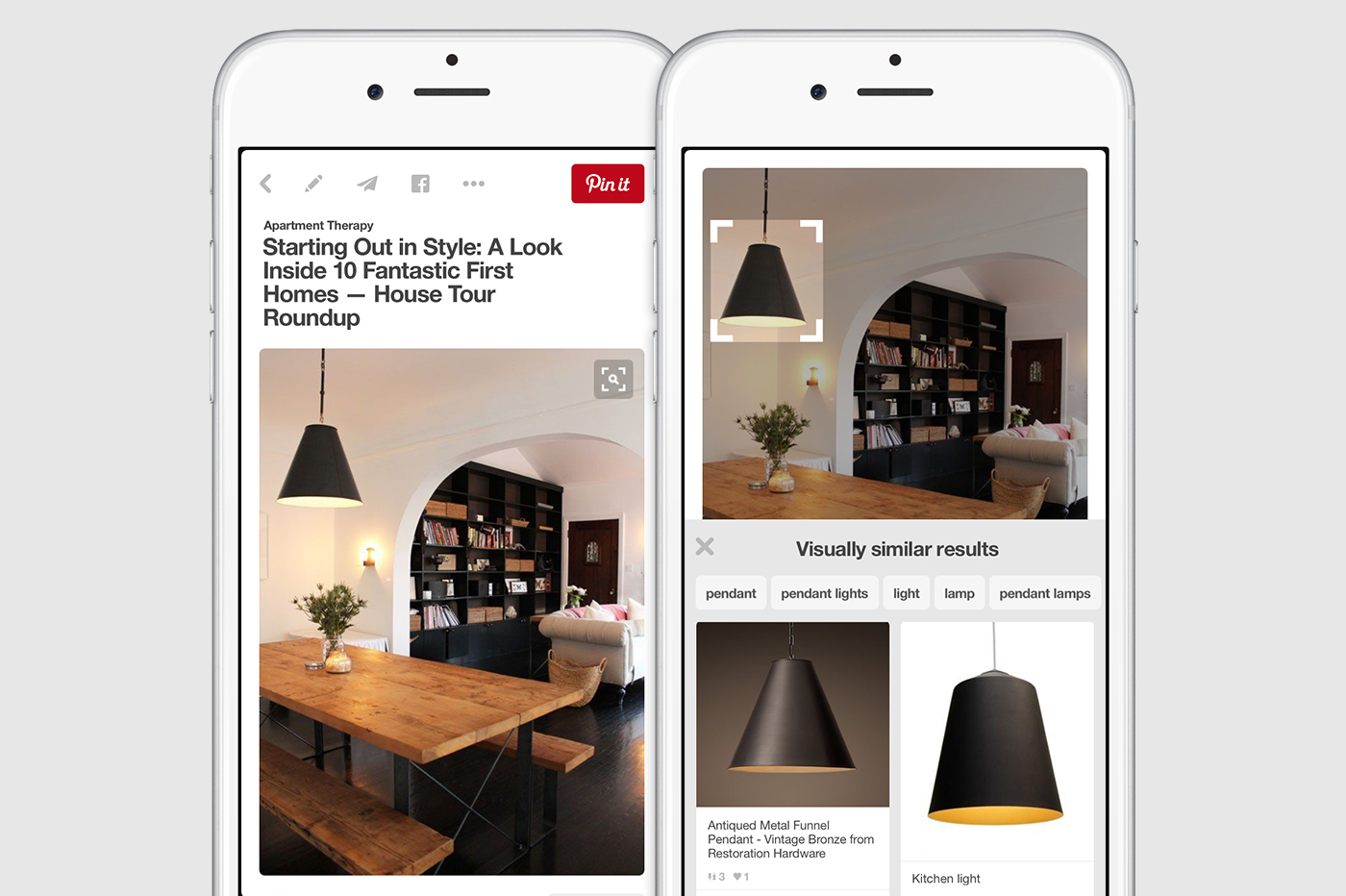

With over two-thirds of Americans now owning a smartphone, mobile is becoming an increasingly important touchpoint for retailers. So it makes perfect sense that Barneys is using beacons, customer profiles, and an on-demand delivery service to bridge the online with the offline via shoppers’ smartphones. Barneys’ new flagship store provides a good example for retailers looking to modernize their stores and provide customers with a consistent retail experience across online and offline channels.

For more information on how retailers can better utilize customer data to connect with shoppers across channels. check out the Boundless Retail section in our Outlook 2016.

Source: Digiday