Today in Hall 4 a conference session was held to discuss NFC and the future. One of the key panelists was Ryan Hughes of Isis, the NFC payments initiative backed by AT&T, Verizon and T-mobile. They have been running trials in Salt Lake City and Austin this past year and discussed some of their findings during the session.

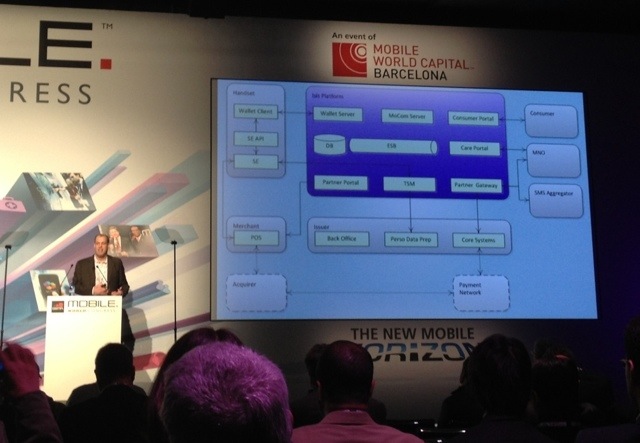

One of the major hurdles they’ve encountered from a usability standpoint is educating consumers on how the technology works, or even that they have the capability in the first place. On the backend side of things, they’ve overcome a great deal of complexity building out their infrastructure. They baseline threshold they’ve set for themselves is for a customer to be able to freeze their Isis account with one call to their carrier if they lose their phone. It sounds simple enough but getting all of the different systems to talk to eachother such that this functionality is possible has taken a lot of doing.

Mr. Hughes showed a 30 second spot for Isis, or at least what one could be like once the product launches wide. In it, we see a woman jogging along and then stopping to pay for things with Isis, to the point where she comes home from her jog with a mountain of shopping bags. Of particular note during this video clip was that at one point she sees a deal on a flyer, taps the flyer to load the deal onto her account, and then redeems the deal at a store. This kind of seamless functionality could go a long way to getting consumers excited about the technology. That said, the really big spike in adoption spurred by this may not hit until NFC-enabled devices reach a price point such that rabid coupon clippers can afford them.

In the meantime, he stressed that Isis does not capture spend data, and actually doesn’t know for sure whether a given transaction had gone through. So they are not collecting data for retargeting, and have no plans to. That relationship is between the customer and the bank.

Bill Gajda, the head of mobile for Visa also spoke. He highlighted that 9 of the top 10 device makers are shipping NFC-enabled phones (no mention of the one holdout). Also, more positively, most new merchant Point Of Sale systems hitting the market today support contactless payments. This is a particularly critical development, since retailers tend to upgrade their equipment once every several years.

Mr. Gajda went on to make an announcement that an agreement had been reached for all nextgen Samsung smartphones will ship with Visa PayWave app for NFC payments.

He went on later in the session to map out the future of mobile payments in the developing world in particular. He speculated that emerging markets will likely leapfrog over traditional fixed line payment systems to mobile terminals that are multi-modal; they can accept card swipes, card taps or NFC taps. These types of devices, if they are affordable to merchants, could rapidly grow in markets that currently operate primarily in cash because of the cost and hassle of traditional POS solutions.

All of the speakers reflected on how for yeas it has seemed as though NFC was right around the corner, and it’s been slow going. They still have enormous faith in the technology and feel as though the industry is getting its ducks in a row for much larger adoption in the coming year.