Just in time for the company’s fifth anniversary, rising Chinese smartphone maker Xiaomi reported yesterday that it broke its own flash-sale record, selling more than two million phones within 12 hours, reportedly generating around $335 million in revenue. The secret to its success besides hunger marketing? A loyal fan base built from smart marketing.

The flash sale, as part of Xiaomi’s “Mi Fan Festival”, is a tried-and-true tactic for the company to leverage its zealous fan base. Besides flash sales, the company also builds up loyalty by routinely hosting exclusive parties and sponsoring festivals for fans across the country, and systematically rewarding fans that volunteer to answer questions on online community forums.

Moreover, savvy social media marketing has also played a big role in Xiaomi’s outreach and community-building efforts. Xiaomi’s page on the Chinese microblog Weibo currently has over 10.7 million followers, and the company typically announces its flash sales and other updates on its social media platforms as well as on popular messaging app WeChat.

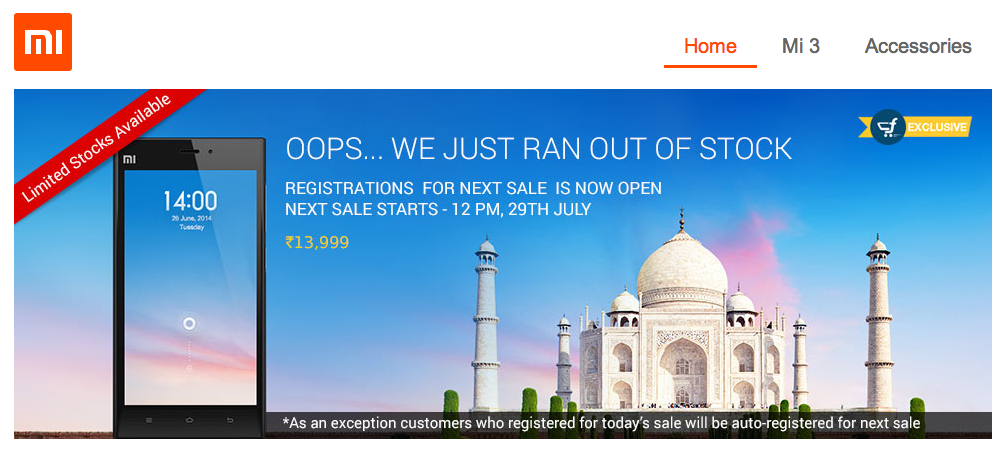

Still, Xiaomi’s ambitious expansion into certain international markets so far has been met with lackluster responses, and a major reason behind such underwhelming performance is that its marketing doesn’t translate well across nations. Without a fan base to hype up its products, Xiaomi suffers from low brand recognition and loyalty in oversea markets. It’ll be interesting to see if the company sticks with its usual marketing tactics, or try something more localized instead.